India's largest state-owned natural gas processing and distribution company, GAIL, announced Oct. 10 that it was working toward establishing Africa as a major supplier of natural gas. Although India's state-level spending has diminished in recent years in conjunction with slowing Indian economic growth, its investment in Africa has continued to grow. Certain West African countries, such as Nigeria and Ghana, naturally attract Indian

India's largest state-owned natural gas processing and distribution company, GAIL, announced Oct. 10 that it was working toward establishing Africa as a major supplier of natural gas. Although India's state-level spending has diminished in recent years in conjunction with slowing Indian economic growth, its investment in Africa has continued to grow. Certain West African countries, such as Nigeria and Ghana, naturally attract Indian

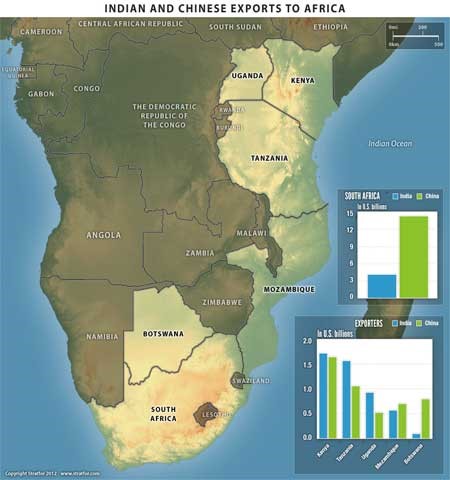

investment and exports for the size of their economies and their recent increases in economic growth, but India’s economic outreach to Africa focuses more on the countries along the Indian Ocean coast -- East Africa and southern Africa account for nearly 70 percent of India's export market in Africa. Historical and cultural ties to East Africa, coupled with the region's potential for high economic growth, will continue to direct state and private Indian investment into the region.

Analysis

India's western coastline lies at one end of a traditional trade route -- one dependent on the monsoon season -- that links the southern coastline of the Arabian Peninsula and East Africa. Modern Indian industries -- both state and private -- view East Africa as a natural extension of their domestic business activities. India's large corporate investments into Africa aim to not only secure valuable raw commodities but also to take advantage of cheap labor costs and secure long-term market share within several of the region's rapidly growing economies. Within this Indian focus on the greater Indian Ocean community, Indian economic activity in some sectors of Africa even outpaces that of China, the leader in many African investment and development projects, by total dollar amounts and as a percentage of gross domestic product.

Indian investment in Africa focuses on a few key industries: energy resource extraction, manufacturing, financial services, agriculture and infrastructure development. For India's private sector, Africa contains promising opportunities at a time when the cost of labor in India is climbing and government and infrastructure bottlenecks are reducing the ease of doing business. Additionally, coastal African countries are a growing destination market for goods and products manufactured regionally by Indian companies.

According to the most recent statistics from the Reserve Bank of India, Africa and Australia in particular -- both members of the broader, informal Indian Ocean community -- have seen a recent increase in outward Indian foreign direct investment. The central government has also taken steps to encourage private Indian corporations to invest in regions it has identified as key interests -- among them Africa and Southeast Asia. It has done this by increasing outbound investment limits and helping smaller companies acquire key assets, particularly in the energy sector, through the creation of special economic vehicles and partnering with public sector undertakings. With growth slowing at home, many private Indian corporations are expected to move offshore, and East Africa and southern Africa provide historical connections and the potential for high economic return. This pattern of Indian investment can be seen in several key economies.

Of the $136 million of Indian FDI into Kenya between 2007 and 2011, nearly 89 percent focused on the manufacturing sector. Indian corporate giant Tata Chemical's soda ash manufacturing plant in Kenya's Lake Magadi region -- valued at about $97 million -- is one of the biggest drivers of this investment. The plant, the largest of its kind in Africa, is also one of Kenya's leading exporters. Rather than producing raw products for export back to Tata's operations on the subcontinent, Magadi exports regionally within Africa, to the Middle East and to Southeast Asia. Consumers along the Indian Ocean account for 95 percent of the plant's annual exports.

Kenya and India share a history, having both been British colonies. Indeed, Kenya hosts an Indian expatriate population of about 100,000, that, despite being part of a population of approximately 34 million, operates nearly 75 percent of successful retail operations in the country, according to Reserve Bank of India and Kenyan High Commission statistics. Kenya, the regional financial center, is also a key export market for Indian goods, consuming $1.7 billion worth of Indian exports in 2011. Given its improving road infrastructure, built in part by Indian and Chinese construction firms, and the fact that it serves as a regional air and rail hub, Kenya offers India export access to Central African states, most notably Ethiopia and Uganda.

Uganda

Like neighboring Rwanda and the Democratic Republic of the Congo, Uganda has experienced strong economic growth since about 2000 due in part to the performance of its agricultural sectors but also due to increased outside investment targeting the region's mineral wealth. Such investment is a result of Uganda's attractive investment climate and good economic governance. Gold, diamonds and coltan -- a critical mineral component in many high-tech devices -- are found in abundance in the region, though more so in bordering states. As in Kenya, India's investments in Uganda extend beyond resource acquisition. Several major Indian corporations, including Bharti Airtel and the Bank of Baroda (India's largest public sector lender), have set up operations in Uganda, hoping to profit from the expansion of the local economy. Service-sector investment has also increased through a joint venture between India's Devyani International and Kenya's Sameer Investments Ltd. that attracted more than $25 million of investment in local hotels and restaurants between 2008 and 2010 alone.

Uganda's and Kenya's import and export infrastructure are intricately linked, especially along the Lake Victoria corridor. Because of this, Uganda, like Kenya, enables Indian investors to increase their involvement in the economies of neighboring countries. Indian investment in Central Africa has lagged behind that of Europe and China, whose investors have been aggressively seeking access to local resources. As India's overall economic growth slows and future development is increasingly constrained by poor infrastructure, Uganda's high GDP growth (averaging about 7 percent a year since 2000) and growing educated labor force could provide Indian corporations with alternative high-growth markets.

Mozambique

Mozambique's Rovuma Basin, which holds significant offshore natural gas deposits (estimated at between 1 trillion and 3 trillion cubic meters), has attracted both public and private Indian investment. With domestic natural gas production at India's offshore KG-D6 natural gas block falling ahead of estimates, securing stable, long-term supplies of natural gas has been a priority for important stakeholders in the Indian economy.

Privately held Videocon and state-owned Bharat Petroleum Corp. each maintain a 10 percent stake in the Rovuma-1 offshore block. The potential for liquefied natural gas production from these natural gas reserves would be a significant boon for the financially troubled fuel refineries and electricity production sector in India. Although New Delhi has been seeking potential LNG supplies from the United States and Russia, even going so far as to invest in U.S. companies operating various shale gas plays, Mozambique could provide a stable, relatively close and dependable alternative to a domestic natural gas sector hindered by overregulation, uncompetitive pricing and sometimes hostile government practices toward private investment.

South Africa

The former British colony of South Africa, which is home to sub-Saharan Africa's largest economy, also hosts the largest community of Indian descent in Africa. The country's large manufacturing base, extensive infrastructure development and abundance of natural resources, such as coal, attract the largest segment of Indian exports to the region. Of India's total FDI of $166 million into South Africa between 2007 and 2011, more than 75 percent was focused on the manufacturing sector.

Tata Steel, owned by the same parent company as Kenya's Tata Chemicals plant at Magadi, operates a high carbon ferrochrome plant near Richard's Bay. In a similar model to Kenya's soda ash production, Tata Steel produces, refines and manufactures nearly 150,000 metric tons of ferrochrome for export every year, with destination markets including North America and China. Tata and other Indian automobile companies, such as Mahindra and Mahindra, also utilize South Africa's strong manufacturing base.

South Africa's large domestic consumer base also attracts Indian investment in hotels, restaurants and the financial services sector. India-based beverage giant UB owns nearly 75 percent of subsidiary United National Breweries, which in turn commands more than 95 percent of the growing domestic sorghum beer market. Indian companies also operate coal mining and electricity production operations in South Africa as well as in Mozambique and Botswana.

South Africa's infrastructure advantage also extends northward into Botswana, another landlocked country with the potential to become a destination for Indian investment. Significant gold and diamonds reserves have attracted not only Suashish Diamonds Ltd., an Indian subsidiary of international diamonds giant DeBeers, but also the Bank of India and Bank of Baroda. Access to South Africa's transport infrastructure and ports has also attracted Indian investment in manufacturing, coal and power production, timber production and jewelry mining in Botswana.

VIDEO: Robert D. Kaplan on China's Port Expansion in the Indian Ocean (Agenda)

Future Development

As the social and political arguments impeding Indian economic growth rage on, many companies have found it easier to do business outside the subcontinent. Although China's investment presence in Africa is more widely seen, and China's stronger political cohesion and economic heft can bring more FDI projects on board (Chinese investment topped nearly $100 billion between 2009 and 2011), there is still room for India between the Western and Chinese investors pouring into Africa. Local leaders often decry China's investment and development strategy as resembling the exploitative, extractive methods of former colonial powers. India's broader portfolio investments guided by a historical connection to a greater Indian Ocean community, conversely, are an alternative to the Chinese approach.